Welcome to the tale of two oil markets edition of Oil Market Daily!

Note: This was first published to HFI Research subscribers via our new Oil Market Fundamental daily report.

The tale of two oil markets is getting more and more attention in the sell-side community. Following Energy Aspect’s commentary last week about PADD 3 refineries hoarding, RBC and Raymond James both came out with an oil report today discussing how PADD 3 refineries have hoarded crude.

Energy Aspect’s Commentary

The gist is that despite the increase in US crude production, US crude exports failed to keep up. This is due to the spread between Brent and WTI MEH being closed. Using WTI Houston as the price proxy, we can see that the spread was indeed compressed:

And the spread indicated a big export month coming for March, which turned out to be an overall draw.

Using the two charts provided by RJ and RBC, this is what would’ve happened to US crude storage:

This is also on the heels of refinery throughput disappointing materially, so the market was obscenely tight.

Perhaps this is another reason why July Brent contract will expire at the highest 1-2 month timespread backwardation in the last 5 years:

If US refineries want to hoard crude, they are going to have to pay a price. The physical market won’t allow this to happen any longer given the recent blowout in Brent-WTI spread as well to $11/bbl.

All this just means that it is only a matter of time before US crude storage plummets lower. And we know based on incoming import data that there won’t be any surprise spikes from the OPEC members.

To further validate our point, the 3-2-1 crack spreads vs. WTI continues to remain elevated:

(Source: CME, HFI Research)

This, combined with the recent widening of the Brent-WTI Houston, means PADD 3 storage will be squeezed from both sides – higher refinery throughput and higher US crude exports.

For this week’s report, there was also no release of SPR, so the draw estimate is 3.4-5.4 mbbls.

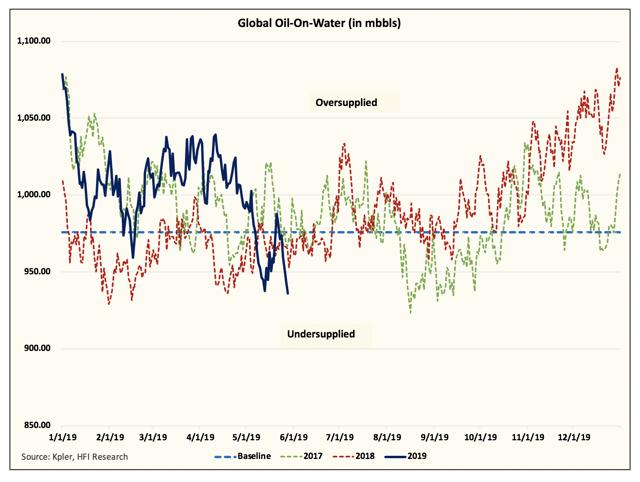

On the global oil side, we are seeing global oil-on-water trend lower, as we had expected in our weekend write-up:

Global floating storage is now down to ~64 mbbls:

Out of the 64 mbbls, 30 mbbls belong to Iran, while 15 mbbls belong to Venezuela:

(Source: Kpler, HFI Research)

The Malacca Strait, a good indicator of crude surplus/shortage in Asia, shows low floating storage count:

(Source: Kpler, HFI Research)

In our view, all of this supports the recent tightening in Brent timespreads. But despite the move up in the 1-2 today, it appears that the 2-3 month timespread pulled back slightly:

This is not a cause for alarm, but we will be watching how the August contracts perform after July expires.

For our UWT trade, we are staying long, as we believe once refinery throughput increases, US crude storage will draw. And according to satellite imaging data, Cushing looks to have drawn ~314k bbls, indicating an increase in PADD 2 throughput.

Conclusion

All in all, the global tightness we are seeing in the oil market will drag US crude storage lower. Whether it’s higher US refinery throughput or higher US crude exports, US crude storage will draw into year-end. We have also stated our forecast for year-end at below ~380 mbbls, or nearly ~100 mbbls lower than today’s level.

We are confident in this projection.

Thank you for reading this article. We recently launched our oil trading portfolio along with the HFI Portfolio. The oil trading portfolio is designed to take advantage of short-term long/short oil trades in the market. For readers interested in our positioning along with real-time trades, we are now offering a 2-week free trial. Here are the results so far:

Disclosure: I am/we are long UWT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.