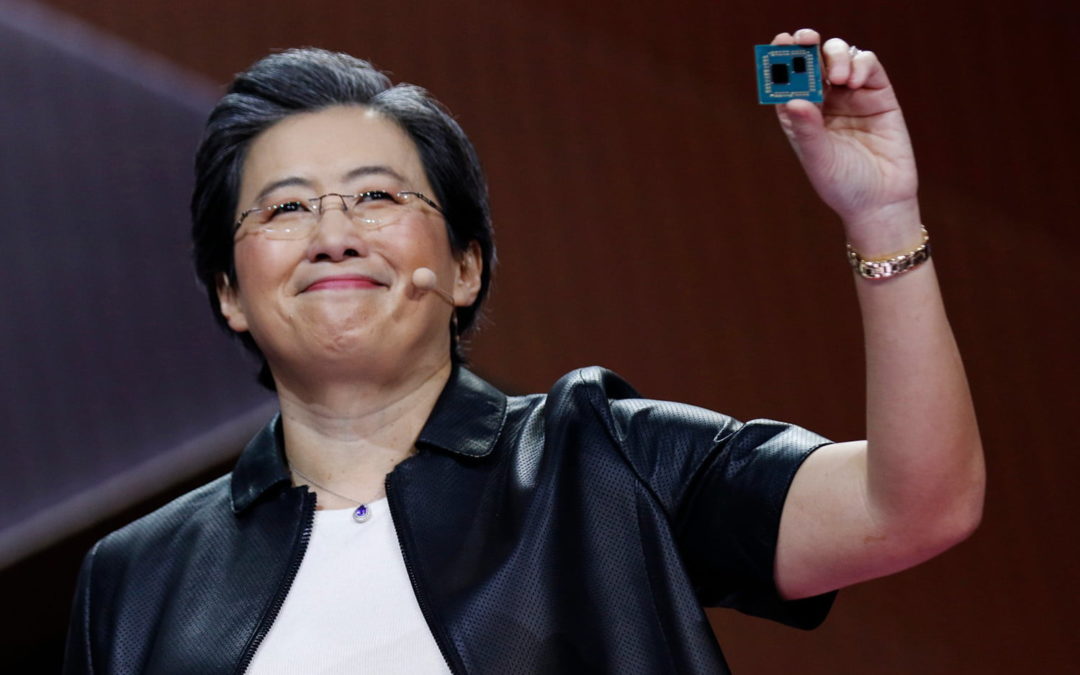

AMD recently made a well-publicized spate of new product announcements at Computex 2019 in Taipei and it seems that both enthusiasts and investors alike were thrilled with what Dr. Lisa Su and Co. presented to the world.

If you’ve been living under a rock or just simply too busy to keep up with the flurry of news coming out of Computex, we’ve covered it all. AMD presented briefly on its upcoming family of graphics processors codenamed ‘Navi’, but what really stole the show was impressive announcements regarding its 7nm CPUs: Ryzen 3000 and next generation EPYC parts. I’ll leave the detailed specs and performance previews up to our Hardware team, but in short, the results look quite promising.

Promising Ryzen 3000, EPYC ‘Rome’, and Navi products prompt analysts to call for increased market share for AMD

The preview was enough to prompt some analysts to call for an increase in market share for AMD – primarily at the cost of chief rival Intel. Cowen analyst Matthew Ramsey covers the semiconductor sector for the firm and presented a very optimistic case for the chipmaker.

Ramsey writes in a note to investors, “We anticipate these products will drive above-consensus growth, share gains, margin expansion, and AMD share appreciation”. Ramsey said AMD should do “very well” in the data center market – he specifically names the cloud-computing segment due to the strengths of upcoming EPYC server parts.

His opinion was probably influenced by AMD’s benchmark demo that showed an EPYC versus Xeon system running against one another. The EPYC system won handily and it’s important to note the AMD system is expected to be a fair bit cheaper given what we know about Xeon pricing.

Along a similar line of thought was analyst Kevin Cassidy at Stifel. Cassidy wrote that his Buy rating for AMD was reaffirmed without going into greater detail than “[Zen 2 will allow AMD]to accelerate its PC market share gains due to higher performance, lower power usage, lower cost and ease of upgrade”.

Cassidy believes AMD shares are worth $34 while Ramsay believes the stock has upside all the way to $36/share.

It seems many investors agree as shares of Advanced Micro Devices (NASDAQ:AMD)soared today, easily posting the best day on Wall Street out of the major technology companies. AMD stock traded as high as 11.5 percent up, but relaxed to just under a 10 percent gain on the day closing at $29.03/share.

Perhaps on a related note, rivals Intel (NASDAQ:INTC) and Nvidia (NASDAQ:NVDA)dipped today.

Share

Tweet

Submit